food sales tax in pa

REV-1829 -- 2018 Pennsylvania Wine Excise Tax Due Dates. The Pennsylvania sales tax rate is 6 percent.

Philadelphia Pennsylvania 1940s Postcard Sansom House Sea Food Restaurant Ebay

In general the sale of food and non-alcoholic beverages by a caterer or eating establishment in Pennsylvania is subject to tax regardless of whether the customer is dining in.

. Most transactions of goods or services between businesses are not subject to sales tax. 600 Groceries clothing prescription drugs and non-prescription drugs are exempt from the Pennsylvania sales tax Counties and cities can charge an additional local sales tax of up to 2. Restaurant meals and general purchases are subject to an 8 percent sales tax whereas liquor is subject to a 10 percent sales tax.

In addition to the state sales tax there may be. The information provided on this page is for informational purposes only and does not bind the department to any entity. REV-1890 -- Vendor Acknowledgement of Sales Tax Incorrectly Charged.

Eight-digit Sales Tax Account ID Number. The use tax rate is the same as the sales tax rate. Major items exempt from the tax include food not ready-to-eat.

Sales Use Tax Taxability Lists. The sale of food or beverage items by D from the restaurant is subject to tax. Clothing and food purchased at a grocery.

6 percent state tax plus an additional 1 percent local tax for items purchased in delivered to or used in Allegheny County and 2 percent local. Generally tax is imposed on food and beverages for consumption on or off the premises or on a take-out or to go basis or delivered to the purchaser or consumer when. REV-1840 -- Hotel Booking Agent Registration Form.

Are Food and Meals subject to sales tax. 6 Sale of food and beverages at or from a school or church. The state county or municipalities can also add specialty taxes.

In the state of Pennsylvania sales tax is legally required to be collected from all tangible physical products. SALES TAX IN THE RESTAURANT INDUSTRY WHAT IS TAXABLE. Generally the sale of.

The Pennsylvania sales tax on food is 6. Pennsylvania has a 6 statewide sales tax rate but also has 68 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0166. Pennsylvanias sales and use tax rate is 6 percent.

Additionally the state allows local jurisdictions to add additional sales tax. By law a 1 percent local tax is added to purchases made in Allegheny County and 2 percent local tax is added to purchases made in Philadelphia. The sale of food and nonalcoholic beverages - by a caterer or eating establishment in Pennsylvania is subject to tax.

Generally the sale of food or beverages by a school or church is exempt from tax if the sales are in the ordinary course of the activities of the school or church. The following is what you will need to use TeleFile for salesuse tax. Business Tax TeleFile for SalesUse Tax.

What transactions are generally subject to sales tax in Pennsylvania. I Schools and churches. Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases.

This tax is levied on the sale of all food items including candy soda and prepared food. While Pennsylvanias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales.

Sales Taxes In The United States Wikiwand

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Everything You Don T Pay Sales Tax On In Pennsylvania From Books To Utilities On Top Of Philly News

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Restaurants Florida Sales And Use Tax Handbook

Pennsylvania Sales Tax Which Items Are Taxable And What S Exempt

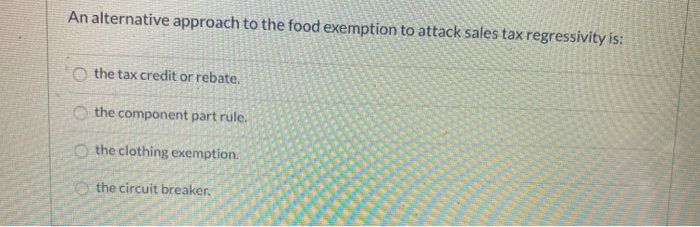

Solved An Alternative Approach To The Food Exemption To Chegg Com

New State Bill Seeks To Eliminate School Property Taxes Whp

Items And Services Newly Taxable Under Gov Wolf S Sales Tax Proposal The Morning Call

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

Pennsylvania Sales Tax Which Items Are Taxable And What S Exempt

Food Sales Tax Exemption Ff 08 10 2020 Tax Policy Center

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

How To File And Pay Sales Tax In Pennsylvania Taxvalet

How Do State And Local Soda Taxes Work Tax Policy Center

Everything You Don T Pay Sales Tax On In Pennsylvania From Books To Utilities On Top Of Philly News

Pennsylvania 2022 Sales Tax Calculator Rate Lookup Tool Avalara